You have to think flexibly about whether to use or borrow money.Let me explain about the mortgage loan of the lease deposit.

When a large amount of money is suddenly required or the interest rate on a loan is burdensome, it is not difficult to transfer to more compliant conditions if you are familiar with the loan information. However, there are quite a few cases where they avoid detailed investigation because it is complicated, and the number of people who are unable to recognize it even though it can be improved seems to be increasing, so we will deal with representative loan information this time. Also, if you look closely, you can attract the financial sector not only for a living but also for the same nature as financial investment funds, so if you have any plans for investment and financial technology, it is recommended to check it out.

For those of you who need to know about jeonse loans

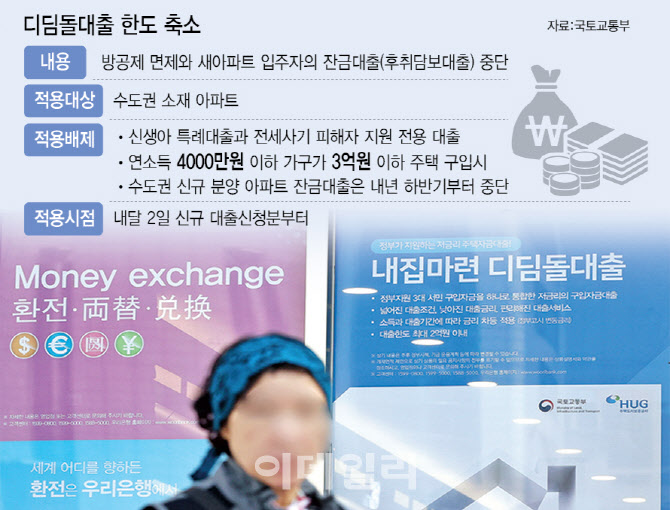

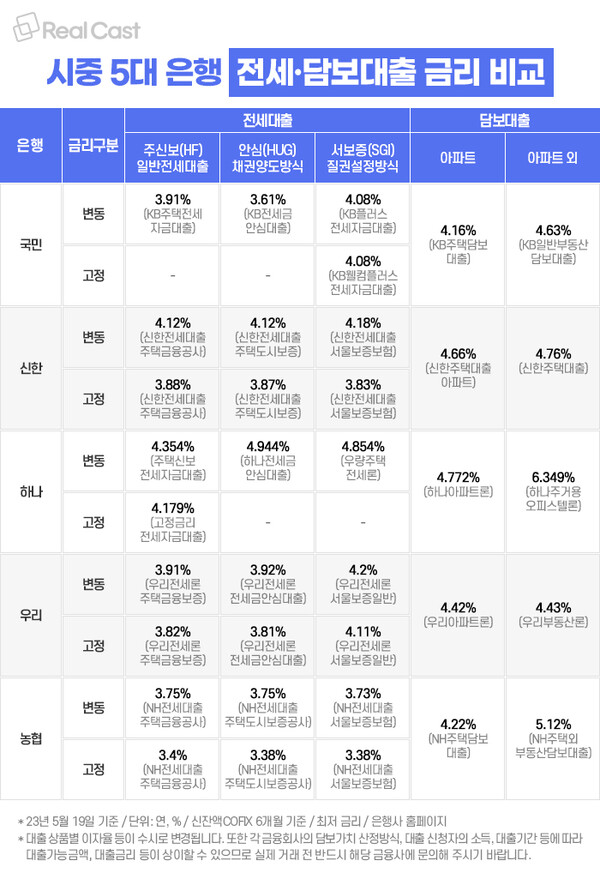

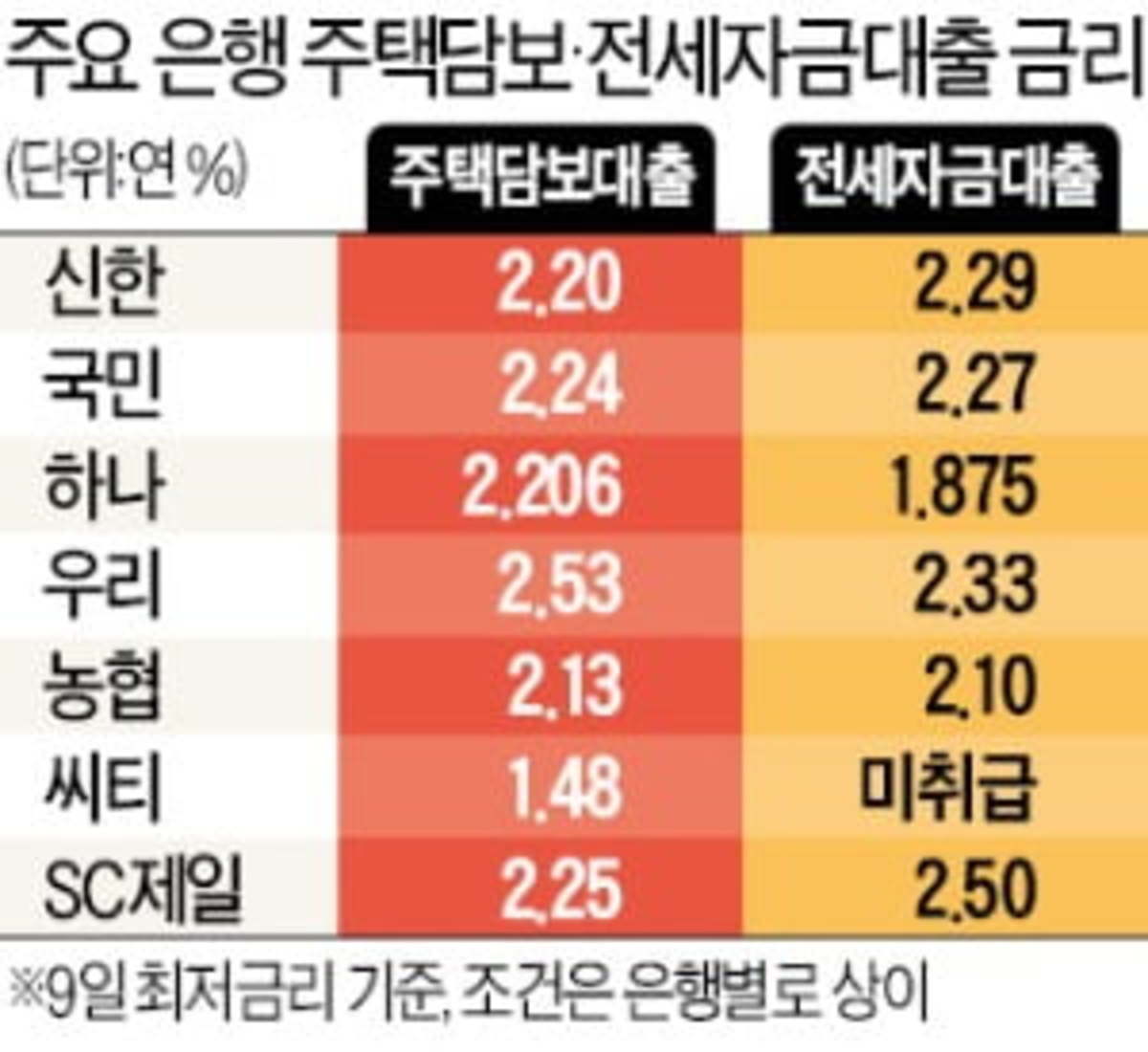

Since each financial sector has different products and benefits, more detailed information will be explained later, so I will summarize only the important differences in this posting. First of all, primary finance such as Shinhan Bank, Woori Bank, and Industrial Bank of Korea has low interest rates because they can be stored without risk. For example, the loan limit is 80% of annual income and credit rating 3, with an average interest rate of 4.90%. Second finance, such as comprehensive financial firms and credit card companies, has a usage limit of more than 110%, but interest rates exceed 14.48%. Therefore, if you need a loan and your credit rating complies, it will be profitable in terms of interest rate to borrow from Cheil Financial Group, but if there are not more than three loans being repaid, it is efficient to go through the secondary financial side.

You can check various types of loans. I’ll tell you about Jeonse deposit collateral loans

If credit is poor at a level that no financial institution can use, there is also a way to choose products for the working class, which is more than 55% cheaper than the average interest rate, which is unconventional. In addition, it is a policy for those who cannot make full use of financial institutions, so it can be received even during income-free or individual rehabilitation. In general, there is a product that supports ordinary people with an annual income of less than 24 million won and a credit score of up to 9 million won at a 10.47% interest rate, but you can’t get it whenever you want without knowing it little by little.

For those who are looking at mortgage loans that can increase returns

Recently, attention has been focused on the financial technology market as investment means using small amounts have gradually increased, but in the case of real estate loans, there is a 55% difference in LTVs by region such as speculative areas, but the key is that they can enter the investment market without their own money. However, since the maximum limit is set in the KB market price of collateral housing, it is necessary to closely examine the increase in housing prices and interest rate fluctuations. In addition, there are cases where credit loans are used to prepare 19 million won and participate in the stock investment market to generate returns exceeding 4% interest rates, but risks exist depending on the stock situation, so you should study carefully and use them efficiently.If you know it meticulously, you can use it whenever you need it.Sharing information on lease deposit collateral loansAs the number of people doing two jobs is increasing, loans can be used in a meticulous way to get wealth quickly in modern society where attention is focused on investment stocks for economic freedom. However, it is easy to lose money if you approach it greedily, so you have to choose the right loan product for the purpose of use, and if you use credit loans frequently, the monthly repayment can be reduced by about 400,000 won, and mortgage loans can be 42% cheaper by more than 1.45 million won. So far, we have dealt with unknown benefits for ordinary people and loan products, but when you have to raise a lot of money, it is good to find out in detail and use them efficiently.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image